Governance Dilemmas - Decentralisation and Trade-offs in Layer 2 Networks

Layer2 Governance BGIN Block #12

Key Takeaways:

Layer 2 definitions vary widely from technical implementations to cultural meanings

L2 solutions present tradeoffs between transaction speed, cost, and decentralisation

Three key attack vectors exist: smart contract governance, sequencer centralisation, and data availability

Ethereum's pluralistic governance contrasts with Bitcoin's more rigid approach

Users typically prioritise cost and speed over decentralisation when choosing L2s

Defining the Undefined

The BGIN Block #12 session in Tokyo began with a fundamental question that revealed a surprising lack of consensus: "What is Layer 2?" Participants offered varied perspectives:

"L2 is a full-layer blockchain that allows fast and efficient transactions without damaging L1 governance," offered one developer, while others emphasized rollups, scalability solutions, and application-specific chains.

This definitional ambiguity isn't merely academic—it speaks to the core challenge facing the ecosystem. As one participant noted:

"We're building critical financial infrastructure on technology that we haven't even clearly defined yet. This definitional confusion is precisely why this governance discussion is necessary."

The Values at Stake

When examining what Layer 2 solutions should preserve from Ethereum's Layer 1, participants identified several core values:

Self-sovereignty: Users maintain control over their assets

Decentralisation: No single entity controls the network

Smart contract programmability: Flexible application development

Developer community empowerment: Open contribution model

Pluralism: Diverse views and approaches are welcomed

Security and trust minimisation: Reduced need to trust intermediaries

Credible neutrality: Protocol doesn't favor specific users or use cases

"Ethereum's pluralism stands in stark contrast to Bitcoin's more rigid governance," observed one participant. "Ethereum's culture explicitly supports diverse ideologies, communities, and use cases, which creates both opportunities and challenges for Layer 2 governance."

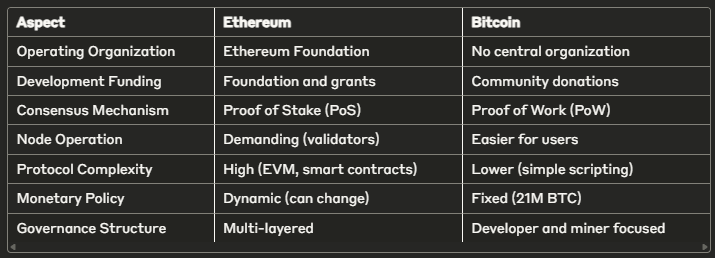

Ethereum vs. Bitcoin: A Governance Comparison

To frame the L2 governance conversation, participants mapped the differences between Ethereum and Bitcoin governance across several dimensions:

This comparison highlighted a crucial insight: decentralisation exists on a spectrum and varies across different layers of the stack.

"Centralization is not black or white," explained one participant. "It depends on what part of the stack you're looking at—staking, development, infrastructure, or governance itself."

Layer 2 Attack Vectors

The session identified three primary attack vectors in Layer 2 architectures that could undermine Ethereum's governance model:

1. Smart Contract Governance (L1 Bridge Contract)

Most Layer 2 solutions rely on bridge contracts that lock ETH on Layer 1. These contracts are often:

Administered by the L2 team or foundation

Upgradable through multisig or timelocks

Potential single points of failure

"If this contract is upgradable or centrally governed, it could be exploited or censored," warned one participant. "We've seen bridge hacks result in hundreds of millions in losses."

2. Sequencer Centralisation

Sequencers bundle and submit L2 transaction data to L1, introducing risks:

Censorship: refusing to include certain users' transactions

Transaction reordering or front-running

Downtime or malicious submission of data

"Most major L2s today use centralized sequencers for performance," noted a participant. "This creates a central point that could undermine Ethereum's censorship resistance."

3. Data Availability Layer

To save on gas costs, some L2s store transaction data off-chain, which creates new challenges:

If off-chain data is lost, users may lose access to prove their balances

New economic security models relying on token-based incentives

Additional trust assumptions beyond Ethereum's security model

The Scalability Trilemma in Action

The discussion revealed how Layer 2 solutions embody the classic blockchain scalability trilemma—balancing decentralisation, security, and performance:

"There's an inherent tradeoff between performance and security," explained one participant. "Posting all data on-chain is most secure but least scalable. Moving data off-chain improves scalability but increases trust assumptions and attack surfaces."

Specific technical approaches have emerged to navigate this trilemma:

EIP-4844: Enables cheaper on-chain data storage via "blobs" (an intermediate solution)

ZK Rollups: More secure and potentially faster, but less EVM-compatible today

Optimistic Rollups: More widely deployed due to simplicity and compatibility

Off-chain Data Availability (DA) layers: Systems like Celestia, Avail, and EigenDA that introduce their own token economics

"Each L2 creates its own token ecosystem and validator set," observed a participant. "This raises questions about added complexity and whether it actually improves decentralization."

The User Perspective: Cost Over Decentralisation

Perhaps the most sobering insight from the session was the acknowledgment that users typically prioritise cost and speed over decentralisation when choosing Layer 2 solutions.

"Users are often unaware or indifferent to the degree of decentralization of each L2," noted one participant. "The most popular L2s today are highly centralized but offer low fees and fast transactions."

This creates a fundamental governance challenge: centralisation is often incentivised because it's more efficient, which could ultimately undermine Ethereum's long-term vision and values.

The group discussed potential approaches to this dilemma:

Introducing classification systems for L2s based on decentralisation level

Creating user-friendly metrics and dashboards comparing L2s on both performance and governance

Encouraging specialised L2S for different use cases (trading, gaming, social, etc.)

"Enterprises may actually avoid centralized L2s due to security and compliance needs," suggested one participant, noting that different user segments may have different governance requirements.

Next Steps: From Theory to Action

The session concluded with an agreement to shift the focus of the working group's research from the Ethereum Foundation's view to the user perspective—examining how users assess and choose L2s based on various tradeoffs.

Key research questions identified for future exploration include:

Which Layer 2 architectures are best suited for specific use cases?

How can users better evaluate the governance structures of Layer 2 solutions?

What metrics or frameworks could help classify Layer 2s on their decentralisation properties?

The Path Forward

The BGIN Layer 2 Governance working group will continue exploring these questions through biweekly sessions, with a particular focus on developing frameworks that can help users and builders navigate the complex governance landscape of Layer 2 solutions.

As one participant summarized: "Layer 2 solutions will define Ethereum's future. Whether they preserve or undermine its core values depends on our collective ability to understand and shape their governance."

Get Involved

If you're interested in contributing to the ongoing research and discussion around Layer 2 governance, join the IKP working group's biweekly sessions, where Layer 2 governance will be one of three rotating topics.

This blog post is based on discussions from BGIN Block #12, Tokyo, Japan, March 2, 2025.

For more information about BGIN and upcoming events, visit BGIN.

Join the conversation on our forum & Working Group Calls.