Enterprise Soulbound Tokens: SMBC, Deutsche Bank, Louis Vuitton

SoulSync State of Soulbound Tokens Issue #2

“I shall dissolve our partnership when this seems the proper course, and even now while we are bound one to the other the partnership will not be on equal terms: the soul will assume undivided authority. Refusal to be influenced by one’s body assures one’s freedom. ”

— Seneca | Letter LXXVI, Letters from a Stoic

Enterprise Soulbound Token Applications

In issue #1 of ‘State of Soulbound Tokens’, we explored the success of Binance’s Account-bound Token (BAB). Issue #2 will follow a similar narrative, we will look at three institutions pioneering real world soulbound token use cases. It’s important to highlight the involvement of prominent and recognisable institutions like SMBC, Deutsche Bank and Louis Vuitton, and their rationale behind adopting the Soulbound Tokens as a means to integrate identity in web3 enabled cities, democratise investment opportunities or restrict transferability to increase product rarity.

The adoption of Soulbound Tokens have outpaced other token primitives and standards, such as Bitcoin and NFTs. This coming October 31st, will mark the 15th Birthday of the Bitcoin Whitepaper, and only now is Bitcoin enjoying significant institutional interest and adoption. Similarly, NFTs face challenging winds, as recent news concerning the overwhelming majority (95%) of all NFTs are worth 0 ETH; majority of NFT collections are graveyards of pump and dump scams now laying in a inactive address or x000…. burn address. The concept of the soulbound token first emerged in Vitalik Buterin's January 2022 blog post and was soon elaborated upon in subsequent whitepaper. Despite Soulbound Token’s infant state, the concept and standards are being examined and researched by credible names in financial services, luxury fashion and government agencies.

Having observed and researched the industry extensively, it's unprecedented to see a token standard achieve institutional adoption well before grassroots uptake—this is a clear deviation from the norm. It can be debated if institutional ownership of Soulbound Tokens could be problematic for an industry where fringe adoption generally leads first and sets the foundations.

Regardless, it’s important to showcase a handful of significant research and initial use cases being explored by pioneering organisation and governments. Keep note that these applications do not represent a final product unless otherwise stated.

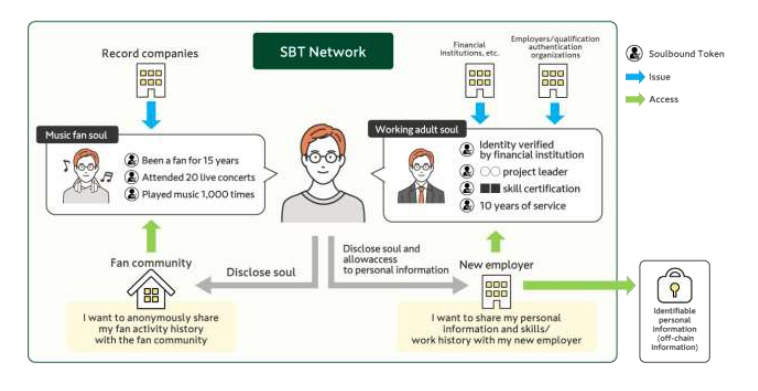

Sumitomo Mitsui Financial Group - Behaviour & Career Attestation

On December 8, 2022, Sumitomo Mitsui Banking Corporation (SMBC), Japan's second largest bank, announced a business partnership with HashPort Group, a blockchain infrastructure provider. This collaboration stemmed from a basic agreement with the aim of developing a Web3 economic zone, initiated in July 2022. Following discussions, the two parties finalised the agreement to commence a joint business venture, centred around the “practical use of Soulbound Tokens”.

The first phase involved SMBC issuing SBTs on a trial basis, with Hashport providing ongoing technical support, until March 2023.

The second phase, based on the outcomes of the initial testing, was planned to include demonstration tests where SBTs would be used as proof of behaviour or career credentials, alongside exploring their use in forming and promoting fan communities through tokens, with the support of interested companies.

I do find it curious SMBC and Hashport’s interest to explore both cultural and productive applications of SBTs. Understandably, fan communities can create rich social context that take a persons ‘identity’ beyond productive capital, and potentially map their ‘culture’. Whereas, behavioural and career attestations would represent again, their productive capita—years in a job, an appropriate issued credential from the organisation of which the SBT and work history originates.

Deutsche Bank

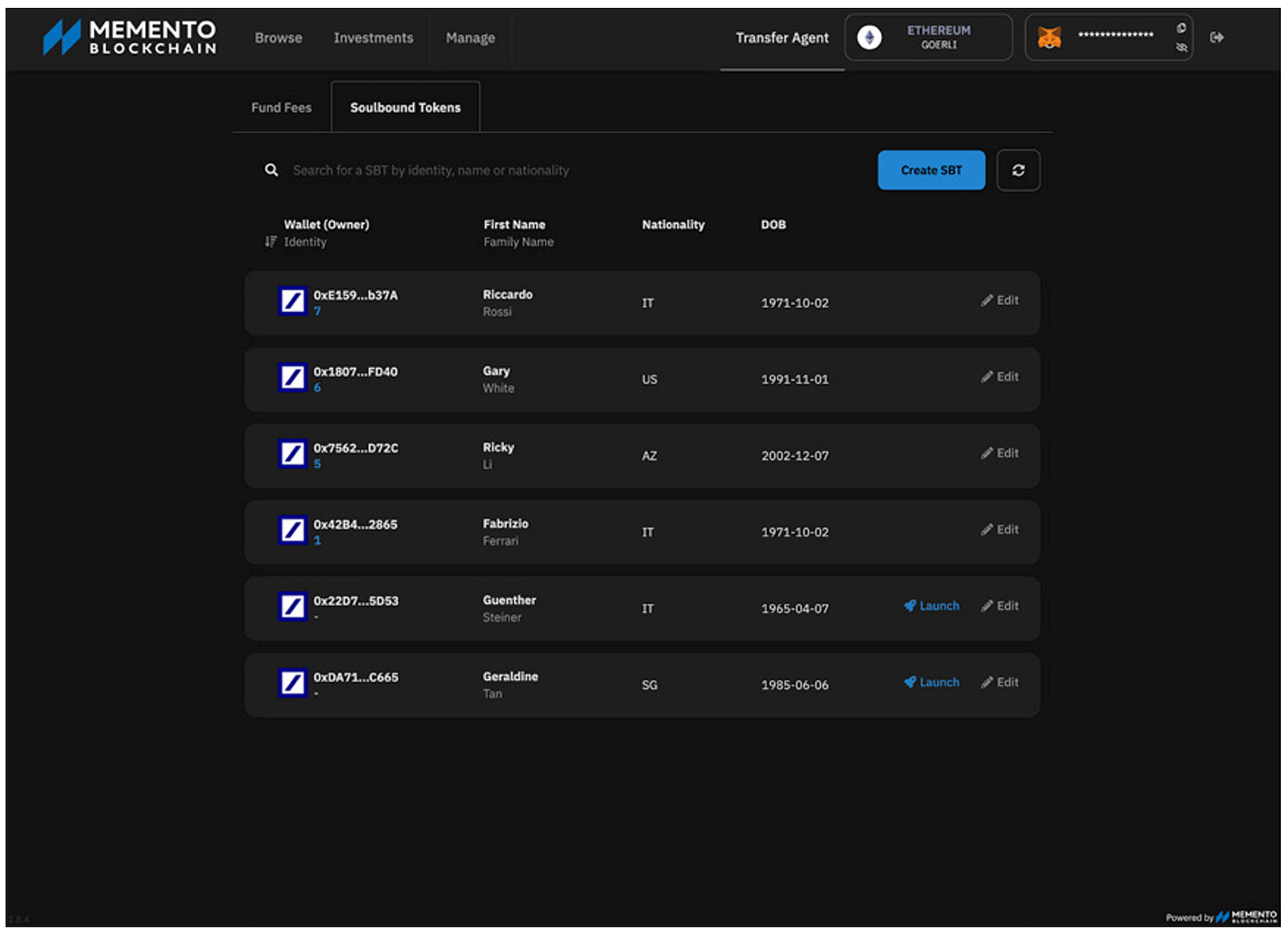

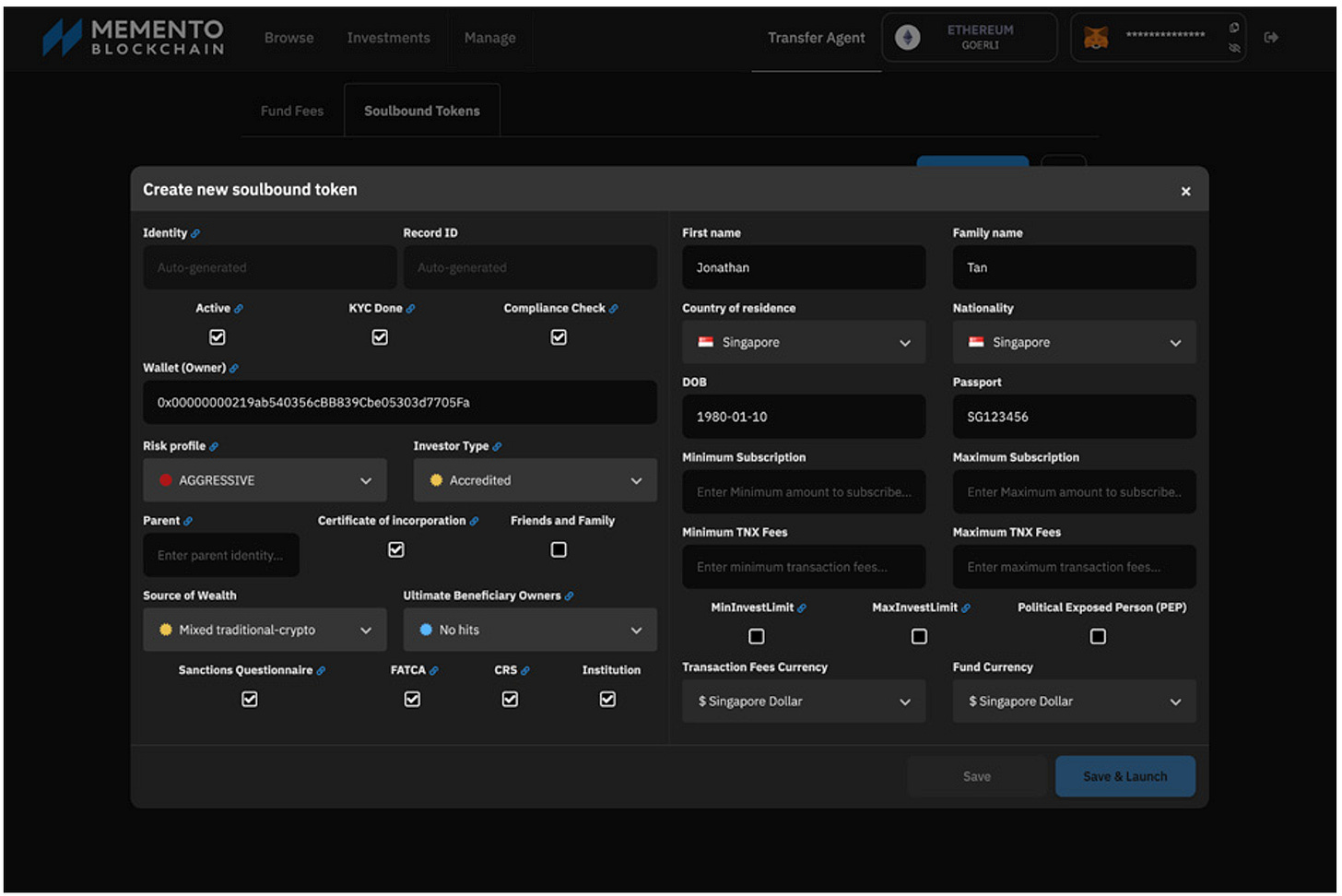

On January 2023, Deutsche Bank, announced its collaboration with Memento Blockchain, introducing Project DAMA (Digital Asset Management Access). Outlined in the Deutsche Bank Flow Report, the joint-project proposes a proof of concept aimed at simplifying digital fund management and investment servicing. The initial concept design is apart of a larger project collaboration, umbrella’d by the Monetary Authority of Singapore's Financial Sector Technology Innovation Proof of Concept scheme.

A key feature highlighted throughout the report was the innovative use of Soulbound Tokens to represent the digital identity of a wallet owner on a decentralised finance (DeFi) investment platform built by Memento on Ethereum. The Soulbound Tokens are engineered to streamline the access to different DeFi investment opportunities irrespective of the fund manager, enabling the user to avoid disclosing the same personal identifiable information multiple times.

The initial phase of Project DAMA saw the creation of SBTs using the commonly used ERC721 NFT standard with transfer functions removed. Although other key SBT characteristics were missed, it will interesting to see how the R&D develops to adapt to new SBT standards. The report describes the role of a ‘Transfer Agent’, which is defined as a trusted intermediary such as a bank to complete the necessary KYC/AML checks, and is required to manage the token’s lifecycle. Upon a successful KYC result the SBTs are minted and issued to the investor's wallet, in similar process to the Binance Account-bound (BAB) Token (read here).

This SBT, once held by an investor, provide access to various funds managed by different asset managers based on the singular KYC check, which could provide an additional layer of security and compliance, but definitively enabling convenient investor experience. It goes without saying this solution will answer many prayers in the funds management industry.

However, questions concerning how daily AML checks are complete, how the token’s lifecycle management is addressed, and how the underlying data portability can meet cross-jurisdiction compliance requirements.

From the outset, the partnership with Memento Blockchain and Deutsche is profound, it validates one of the core use cases of soulbound tokens, streamline KYC processes. Having the pleasure of speaking with Deutsche Bank’s project lead, Mr Boon-Hiong Chan during BGIN Block #8 Croatia conference, I’m instilled with confidence that this project will send waves across the industry for years to come. It will start the conversation on how soulbound tokens can optimise digital fund managers and lower the barrier to entry for traditional asset managers.

Louis Vuitton - Immutable Luxury Membership

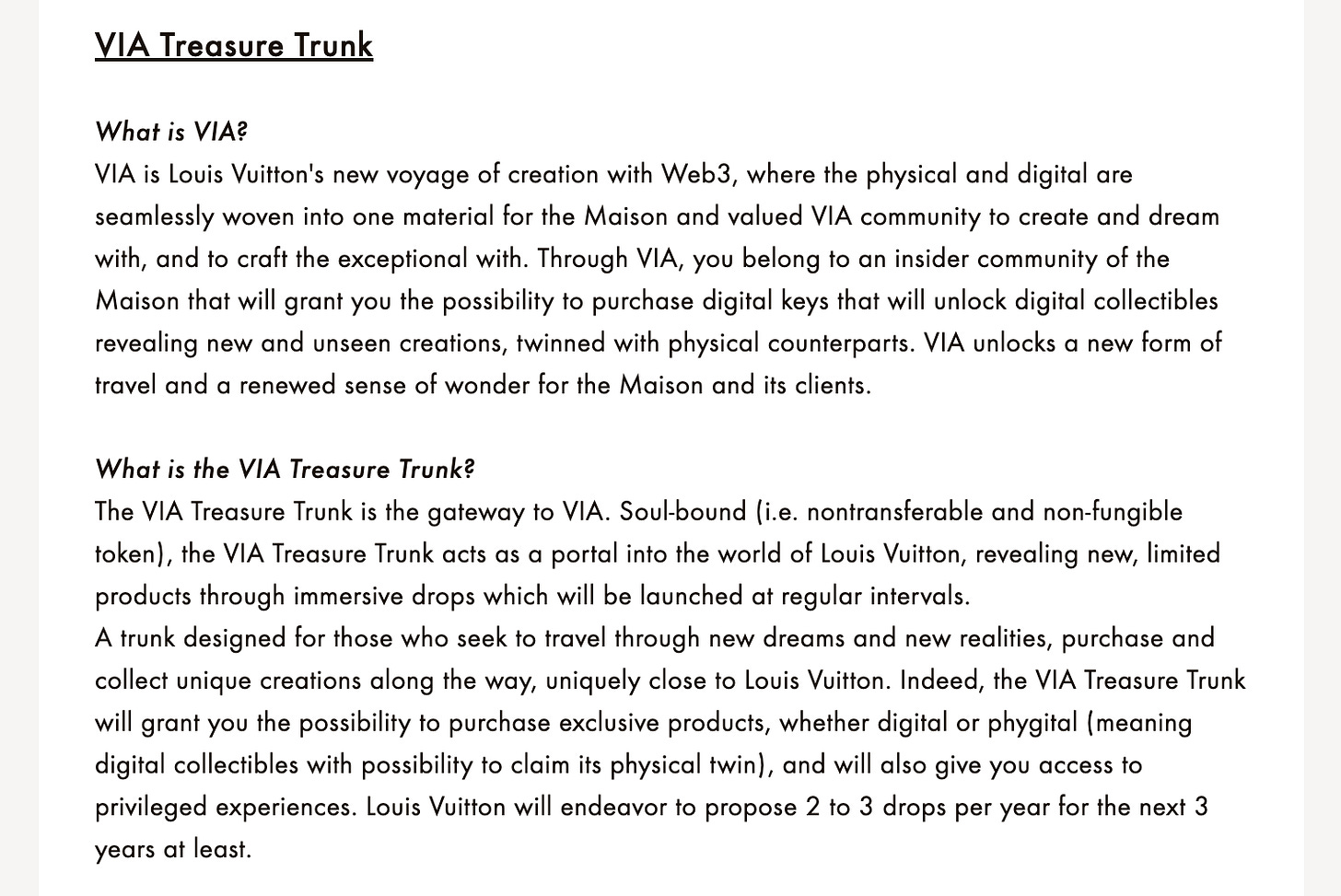

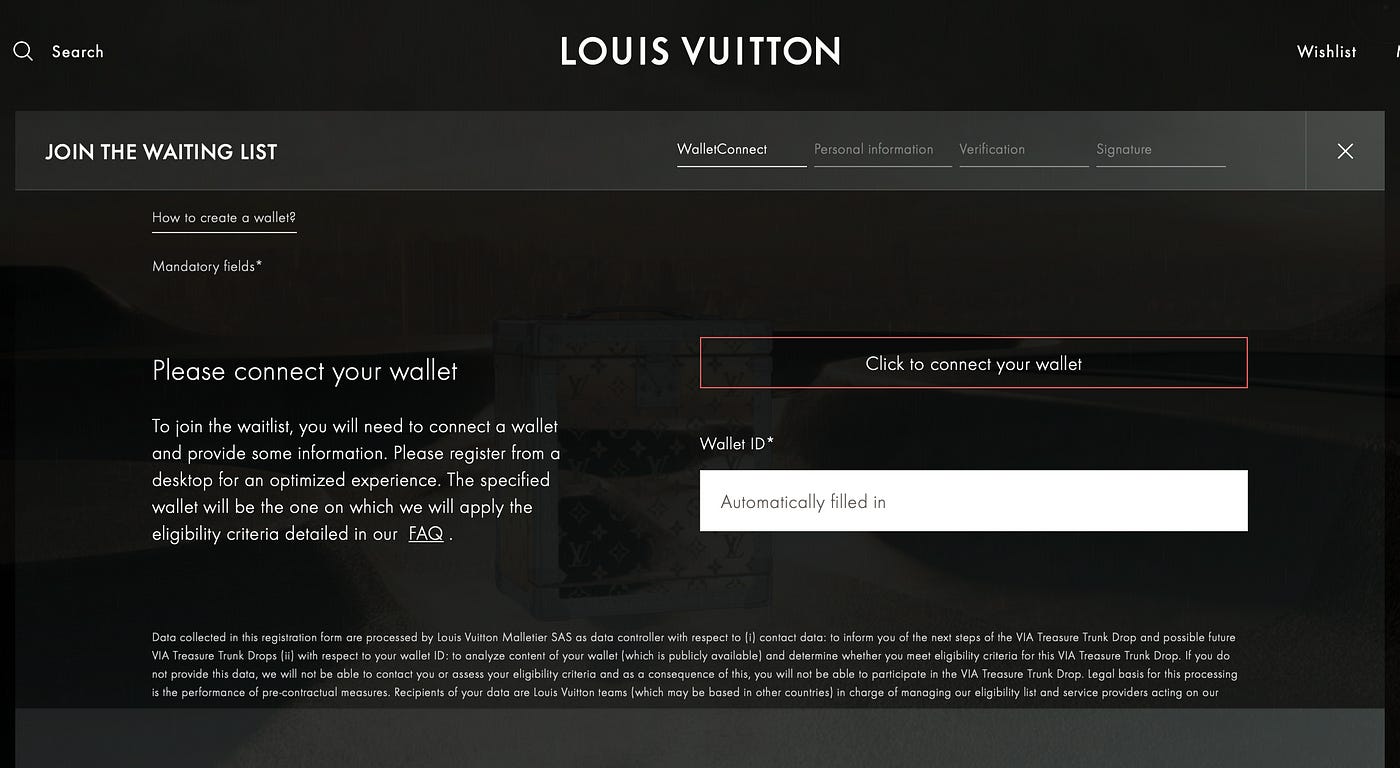

On June 6th, 2023, Vogue Business reported Louis Vuitton’s first NFT drop named '‘Treasure Trunks”, defined as ‘phygital’ items that would provide dozens of exclusive benefits for the owners of the Trunks. Phygital is a commonly used term to highlight a digital asset underpinned by a real asset. The NFT project forms part of Louis Vuitton’s broader ‘VIA’ NFT initiative. Purchasing one of these limited-edition 'Treasure Trunks' would cost a buyer €39,000 but would come embellished with exclusive events, rewards, and membership perks. Unexpectedly, Louis Vuitton opted to use the Soulbound Token standards to mint the VIA trunks. This choice stands out, particularly given the trend of renowned brands like Nike and Time Magazine leaning towards transferable NFTs.

Louis Vuitton rationalised their choice of a Soulbound Token over a conventional NFT as a measure to maintain exclusivity. This ensured that members couldn’t resell or transfer the token, reinforcing the digital assets exclusivity and underscoring the value of the membership.

For a comprehensive take on Louis Vuitton's web3 endeavours and deeper insights into the 'Digital Trunk', Megan Kaspar's article from June 12th on Medium serves as an exemplary resource. Her insights have greatly informed this issue of SoulSync, and her piece comes highly recommended for further reading.

Conclusion: The Growing Relevance of Soulbound Tokens

As we conclude Issue #2 of 'SoulSync: State of Soulbound Tokens', it's evident that the momentum behind Soulbound Tokens is not going away and will continue to be a pivotal innovation enabling dozens of new smart contract use cases. From financial titans like Deutsche Bank and SMBC, who aim to streamline KYC and onboarding processes, to luxury powerhouses like Louis Vuitton that see merit in creating non-transferable exclusive memberships, the utility of Soulbound Tokens is versatile and valued.

The narratives shared in this issue echo a central theme: the value of establishing immutable, non-transferable digital identity, whether it's for a bank customer, an investor, or a luxury brand enthusiast. While grassroots adoption often precedes institutional interest, Soulbound Tokens fall out of this norm. Institutions are recognising the promise and potential of these tokens ahead of the core grassroots community.

Like any novel technology, the journey ahead for Soulbound Tokens are sure to be lined with a fair amount of challenges and debates. But what is clear is that the use cases explored are merely the beginning. It goes without saying that Soulbound Tokens are set to redefine how we perceive digital identity, access, and exclusivity in web3 and the greater traditional markets.

As we anticipate more innovations and breakthroughs in Soulbound Tokens, 'SoulSync' remains committed to providing timely, objective, and comprehensive insights. Thank you for again for reading this issue we look forward to sharing further developments in subsequent issues!