Binance Account-Bound Token (BAB): A Year in Review of On-Chain Identity Verification

SoulSync State of Soulbound Tokens Issue #1

“The harmony of the soul and body, and of the parts of the soul with one another, a harmony ‘fairer than that of musical notes.’”

— Plato | The Republic

Binance Account-Bound Token (BAB): A Year in Review of On-Chain Identity Verification

The Binance Account-bound Token, or rather BAB is a ‘soulbound token’ minted on BNB Chain and represents a user’s successful Binance Exchange Know-Your-Customer (KYC) result. Binance released the new feature exclusive to Binance customers in September, 2022. By 'binding' a user’s successful KYC result to the BAB token, Binance potentially strengthened its compliance measures, and showcased a practical use-case for soulbound tokens.

To many, the BAB token’s introduction was unexpected, especially given that the foundational whitepaper detailing the primary features and soulbound token lead potential, titled 'Decentralized Society: Finding Web3’s Soul', had only been published four months prior on 11th May. This seminal work was a collaborative effort between Ethereum's creator, Vitalik Buterin, 'Radical Markets' author E. Glen Weyl, and Flashbots' Strategy Counsel, Puja Ohlhaver.

The core features of the BAB Token from the Binance.com BAB FAQ:

Binance Account Bound (BAB) tokens are the credentials of Binance users that have passed KYC. Since it is a type of Soulbound Token (SBT), it has three key properties: it is non-transferable, it cannot be transferred from one address to another, and it is revocable. It can be revoked by issuers. One UID can only have one BAB token at one time and on one chain.

Critical Reception of BAB

Binance's hasty implementation of soulbound tokens was bold, but in my humble opinion saw the BAB as a calculated response to the evolving needs of the Web3 ecosystem to have on-chain credentials. Now a year later we have seen the value that on-chain credentials can bring, and with the incoming real-asset tokenisation boom looming, SBT technology could not come any sooner.

Any association with Binance naturally invites critical reception. In the case of the BAB, there are both commendations and pointed criticisms. Supporters have laud the BAB as an innovative approach to on-chain identity verification, potentially creating a new means to identify ‘regulated addresses’ and proof of individual, mitigating adverse selection, deterring malicious actors. On the other hand, there are serious concerns being raised about potential misuse, privacy infringements, and the centralisation of power with entities like Binance.

Defining Soulbound & Account-bound

You may have noticed the single quotation marks around the term ‘soulbound token’, in the first paragraph. This stylistic choice was deliberate. While Binance refers to the BAB token as an soulbound token, the specific choice of words ‘account-bound’ over ‘soulbound’ is clear. The introduction of the term ‘account bound’ has expanded the soulbound token taxonomy whilst equally confusing many to the differences between the two terms.

A separate article might offer a detailed distinction between 'account-bound' and 'soulbound'. To provide you with a simple answer, an account-bound token embodies centralised attributes, such as being issued by an exchange, existing on a private blockchain, and having counter-party arbitration. In contrast, a soulbound token is characterised by decentralised features, which might include self-issuance, existence on a public blockchain, and arbitration by the issuer.

Quantitative Analysis of BAB Token

The BAB token has afforded the industry an innovative and brand new lens through which to examine address behaviour, particularly given a year's worth of interactions from addresses minting/revoking this non-transferable token. The BAB represents a paradigm shift in on-chain data analysis, traditional on-chain analytics aimed to correlate on-chain activities with the actor, utilising an array of datapoints to lend context to these actions in the hopes to map market trends. Such datapoints often include timestamps, asset value changes, and interactions with other addresses.

The BAB provided a new datapoint identifying a ‘regulated entity’ via primary issuance (minting) of the BAB token.

Thanks to Twitter user @coinbender_lfg, for publishing the Dune Analytics Dashboard ‘Binance Soulbound Token/SBT (BABT). (David_C, Dune Analytics Alias) Most up-to-date results are 2 months old.

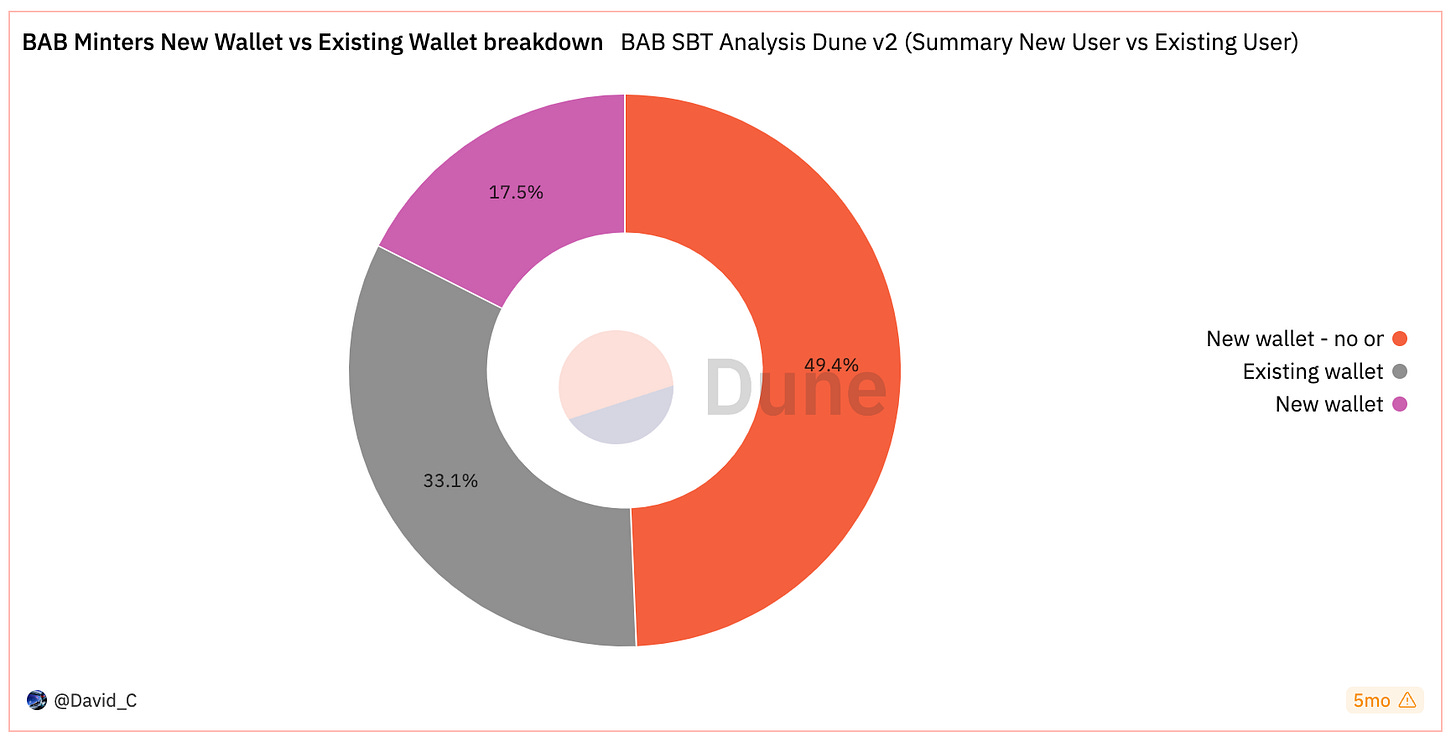

The Dune Analytics dashboard delineates between the BAB mint address’s activity and age, detailing mint addresses that are either a) new (w/o activity), b) new (w/ activity, or c) existing. This delineation is fundamental to evaluating the efficacy of Account-bound tokens issued by centralised exchanges as a means to ‘onboarding the next billion’ users to DeFi.

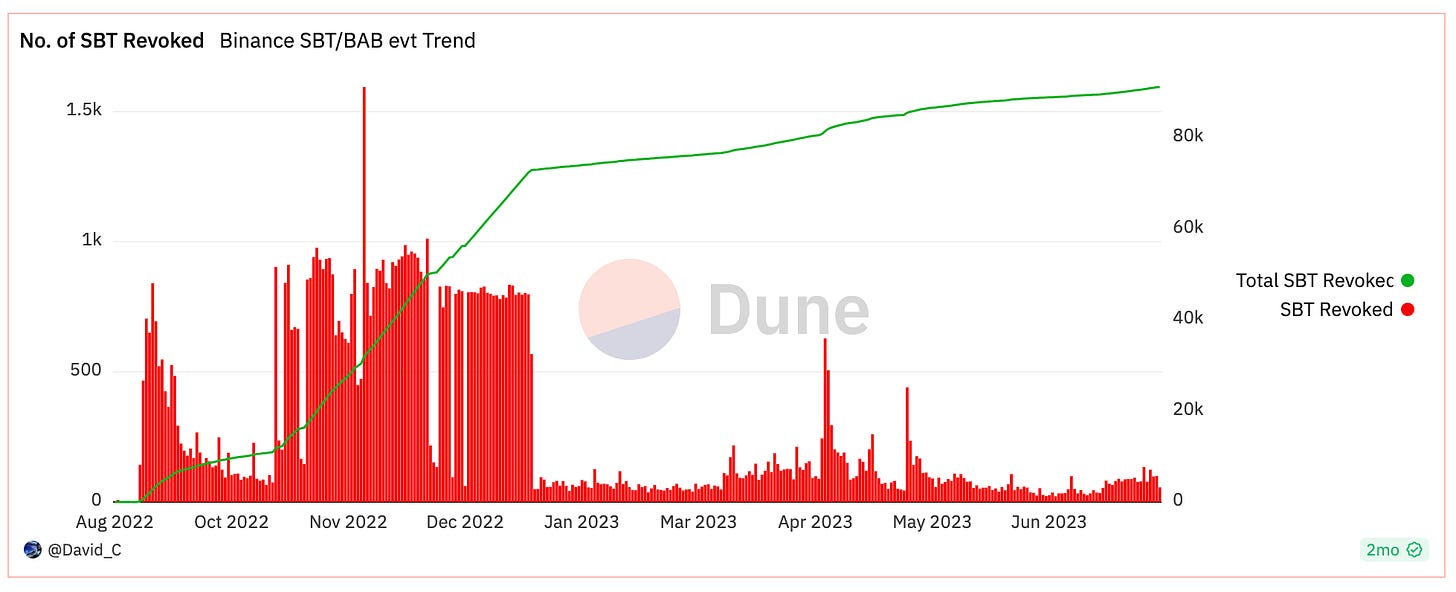

Since BAB inception up until 2 months ago (the latest dashboard stats), there have been over 855,394 BAB tokens minted, with 91,119 BAB tokens revoked, BABT net token count is 764,275.

The sharp jump in BAB revocations on October 21, 2022 is curious, I am puzzled to the exact reason to why there was such a large and abrupt jump in revocations. A Cointelegraph article highlighted that October 2022 was the worst month for hacks, with data sourced from Chainalysis.

An interesting insight from the Dune Analytics dashboard is the number of new wallets created purposefully to hold a user’s BAB Token, with 49.4% of BAB Tokens minted to a new wallet (w/o any on-chain activity), 33.1% minted to an existing wallet and 17.5% minted to a new wallet (w/ on-chain activity). I’m interested to dig deeper into the numbers and determine the To interrogate the data further, I’m interested to understand the split of users who’ve previously had an on-chain address and users who are onboarding into holding their own keys for the first time. Unfortunately the answer is not clear, but is necessary to evaluate the efficacy of Account-bound Token’s as a vehicle to proliferating self-custody amongst numerous other topics.

Conclusion of BAB Review

In my humble opinion, household names like Binance adopting soulbound tokens into their go-to-market strategy signifies the beginning of a new era. As more entities adopt soulbound tokens, we can anticipate a shift in the way we perceive and integrate identity, reputation and value on any blockchain.

Beyond the backyard, traditional companies such as Deutsche Bank are exploring soulbound tokens as a use case, but I’ll put more on that in the following issues of ‘SoulSync’. From observations and anecdotal evidence we can expect early use cases to include anti-fraud systems, secure voting mechanisms, and novel methods of peer-to-peer lending as trust becomes a tangible asset codified into a reputation storing token.

Setting aside criticisms of Binance, the BAB token has undoubtedly advanced the industry and has provided fundamental data to the utility, application and future implementation of soulbound technology.